Our Local Experts are ready to help with all of your questions.

Give us a call.

Call us Monday - Friday 8 a.m. – 6 p.m

844-655-0355Explore Blue KC plans for individuals and families

There’s a lot to consider when deciding which ACA health plan is best for your needs. Here, you can compare coverage levels and learn what information you’ll need to enroll.

Finding an affordable plan with the right coverage is easier than ever

Our new shopping experience makes comparing plans by features that are important to you simple. Plus, you can find out how much you’re eligible to save on your monthly premium.

Levels of coverage

To make it easy for you to shop and compare coverage, our plans provide benefits at a designated level, known as “metallic levels.” Blue KC offers Gold, Silver, and Bronze plans so you can find the right amount of coverage at a cost that works for you.

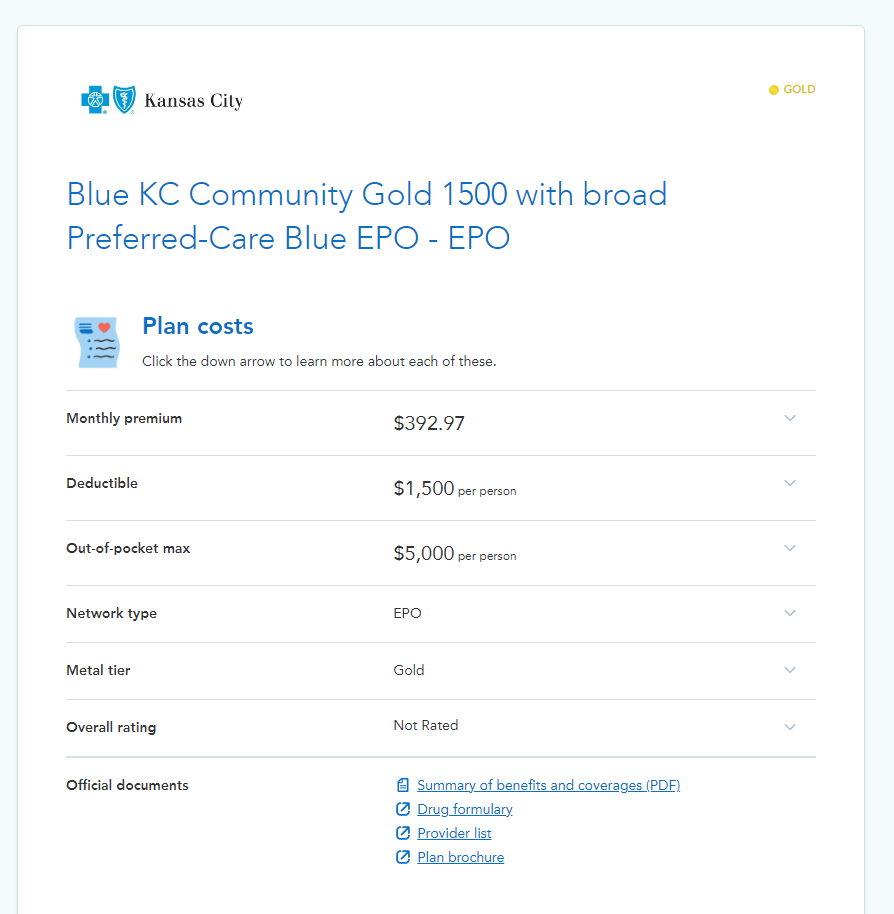

Gold Plans

Pay 80% of covered costs on average

Gold Plans

Pay 80% of covered costs on average

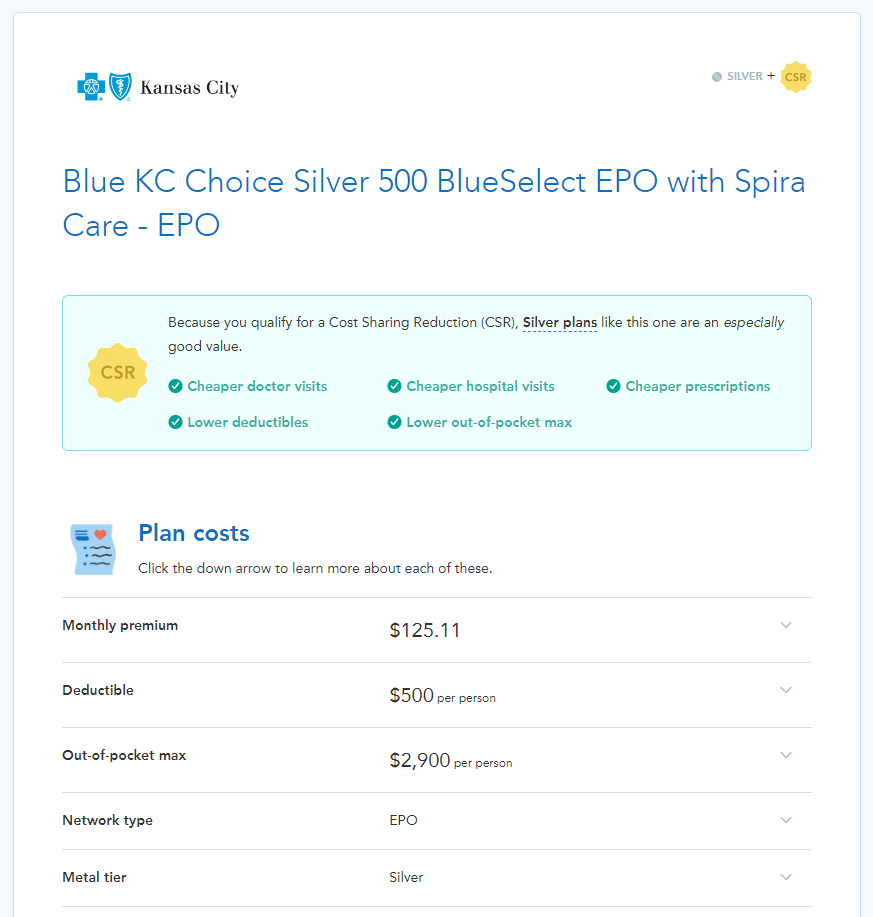

Silver Plans

Pay 80% of covered costs on average

Silver Plans

Pay 80% of covered costs on average

Bronze Plans

Pay 80% of covered costs on average

Bronze Plans

Pay 80% of covered costs on average

More ways to save

Only Blue KC plans give you access to Spira Care centers and care providers—a great way to lower out-of-pocket costs. Enhanced care management and guidance makes it easy to save on office visits and medical costs, without sacrificing your standard of care.

$500

estimated yearly savings for a family of four

$120

yearly out-of-pocket savings for individual

How to choose and enroll in the right plan

There’s a lot to consider when deciding which ACA health plan is best for your needs. Here, you’ll get help with choosing a plan and collecting what information you’ll need to enroll.